The following information pertains to questions

Big Guy Inc.purchased 80% of the outstanding voting shares of Humble Corp.for $360,000 on July 1,2001.On that date,Humble Corp had Common Stock and Retained Earnings worth $180,000 and $90,000,respectively.The Equipment had a remaining useful life of 5 years from the date of acquisition.Humble's Bonds mature on July 1,2011.Both companies use straight line amortization,and no salvage value is assumed for assets.The trademark is assumed to have an indefinite useful life.

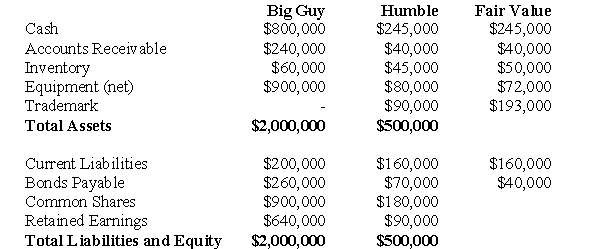

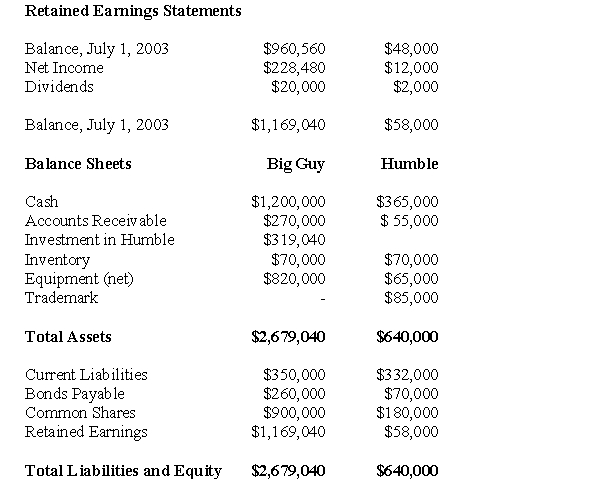

Goodwill is tested annually for impairment.The Balance Sheets of Both Companies,as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

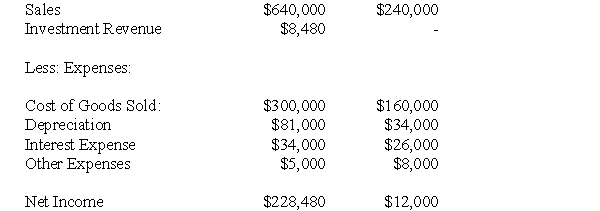

The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

Income Statements:

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

-Big Guy's Consolidated Retained Earnings for the year ended July 1,2004 would be:

Definitions:

Direct Method

An approach in cost accounting where specific costs are directly traced to cost objects without any allocation, ensuring clear cost attribution.

Operating Activities

Activities related to the day-to-day functioning of a business, including selling, administering, and producing goods and services.

Long-term Investments

Investments held for an extended period, typically more than a year, such as bonds, stocks, or real estate, aiming for long-term benefits.

Bonds Payable

Long-term liabilities representing money a company owes to bondholders.

Q4: What is the amount of Goodwill that

Q27: Assume that Parent Inc.decides to prepare an

Q28: Approximately what percentage of the non-controlling interest

Q31: Prepare Alcor's Consolidated Balance Sheet as at

Q33: Translate Wilsen's 2014 Income Statement.

Q34: For the sake of simplicity,assume once again

Q41: Which of the following rates would be

Q45: Lisa would like to start a new

Q49: Assuming that Parent Company purchased 80% of

Q53: What effect (if any)would the unrealized profits