The following information pertains to questions

Big Guy Inc.purchased 80% of the outstanding voting shares of Humble Corp.for $360,000 on July 1,2001.On that date,Humble Corp had Common Stock and Retained Earnings worth $180,000 and $90,000,respectively.The Equipment had a remaining useful life of 5 years from the date of acquisition.Humble's Bonds mature on July 1,2011.Both companies use straight line amortization,and no salvage value is assumed for assets.The trademark is assumed to have an indefinite useful life.

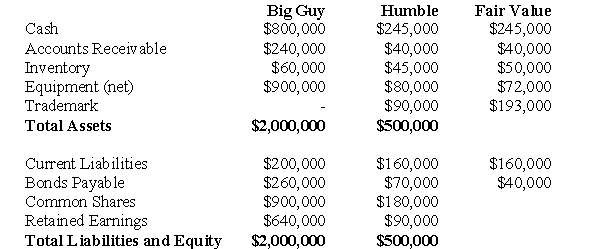

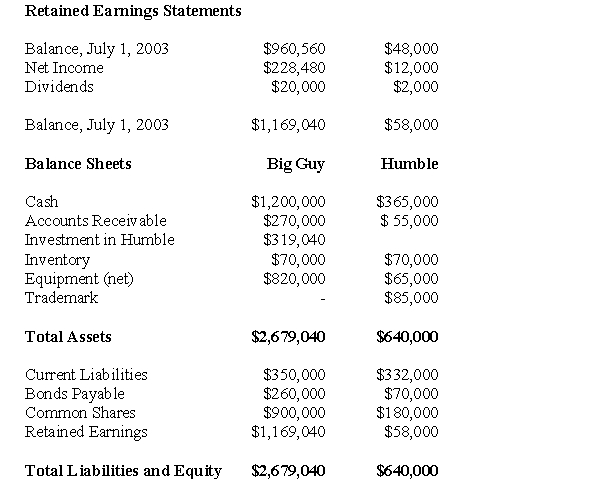

Goodwill is tested annually for impairment.The Balance Sheets of Both Companies,as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

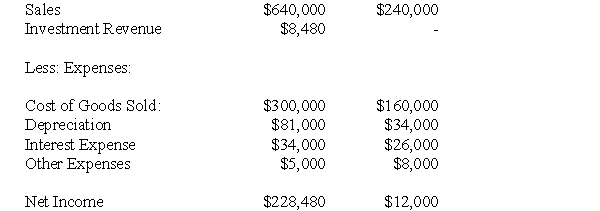

The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

Income Statements:

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

-The amount of interest expense appearing on Big Guy's July 1,2004 Consolidated Income Statement would be:

Definitions:

Weighted Average Periodic Method

An inventory costing method where goods are valued at an average cost, calculated periodically, taking into account the weight of each purchase.

Ending Inventory

The total value of goods available for sale at the end of an accounting period, calculated as the beginning inventory plus purchases minus cost of goods sold (COGS).

Lower-of-cost-or-market

An accounting principle requiring that inventory be recorded at the lower of either its original cost or its current market price.

Ending Inventory

The final stock level of products or materials that a company has in hand at the close of an accounting period, rephrased as "terminal inventory balance."

Q2: The European Union has attempted to harmonize

Q10: Which of the following financial statements are

Q14: Any negative goodwill arising on the date

Q19: Subject: _ <br>Audience: college students<br>Purpose: to explain

Q24: Under IFRS 10,when can a venturer recognize

Q32: A negative acquisition differential<br>A)is always equal to

Q42: Which of the following rates would be

Q47: Translate Martin's December 31,2011 Balance Sheet into

Q48: Private enterprise gap is permitted in certain

Q52: Which of the following rates would be