The following information pertains to questions

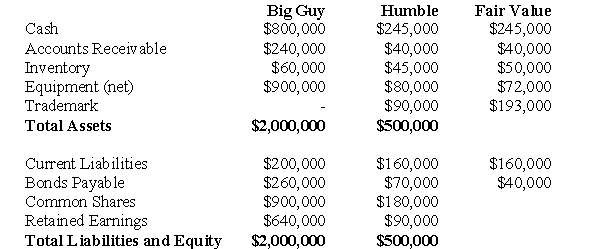

Big Guy Inc.purchased 80% of the outstanding voting shares of Humble Corp.for $360,000 on July 1,2001.On that date,Humble Corp had Common Stock and Retained Earnings worth $180,000 and $90,000,respectively.The Equipment had a remaining useful life of 5 years from the date of acquisition.Humble's Bonds mature on July 1,2011.Both companies use straight line amortization,and no salvage value is assumed for assets.The trademark is assumed to have an indefinite useful life.

Goodwill is tested annually for impairment.The Balance Sheets of Both Companies,as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

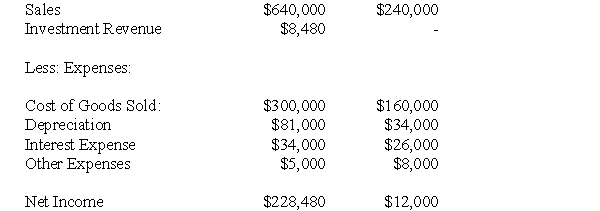

The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

Income Statements:

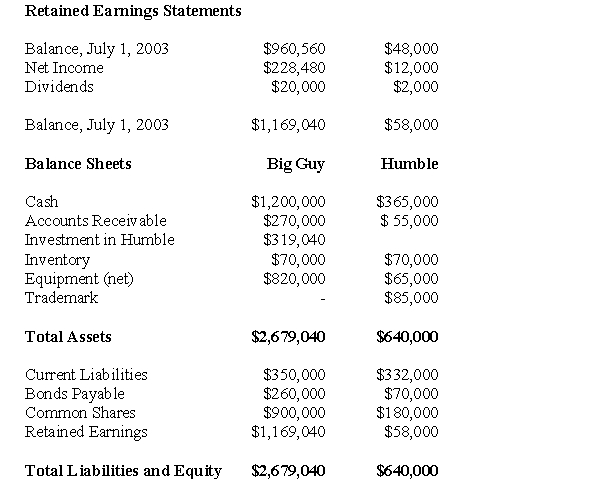

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

-The amount of Accounts Receivable appearing on Big Guy's Consolidated Balance Sheet as at July 1,2004 would be:

Definitions:

Nonrenewable Resources

Resources that cannot be replenished at the same rate they are consumed, such as oil, coal, and natural gas.

Recycling

The process of converting waste materials into new products to prevent waste of potentially useful materials.

Efficient Use

The optimal allocation and utilization of resources to achieve a particular goal or outcome with minimal waste or expense.

Restoration Ecology

Seeks scientific ways to return ecosystems to their state prior to habitat degradation.

Q13: Which of the following was often cited

Q17: Zen Inc.owns 35% of Sun Inc's voting

Q19: Assuming that Keen Inc.purchases 100% of Lax

Q20: If a not-for-profit organization has revenues in

Q21: Prepare the necessary journal entries to record

Q23: The difference between the Investor's cost and

Q24: How much Goodwill was amortized during 2003?<br>A)$700<br>B)($1,700)<br>C)$1,700<br>D)None

Q32: The amount of goodwill arising from this

Q32: Types of pain<br>A) sharp, shooting pain<br>B) burning

Q69: Subject: steps to follow to obtain a