The following information pertains to questions

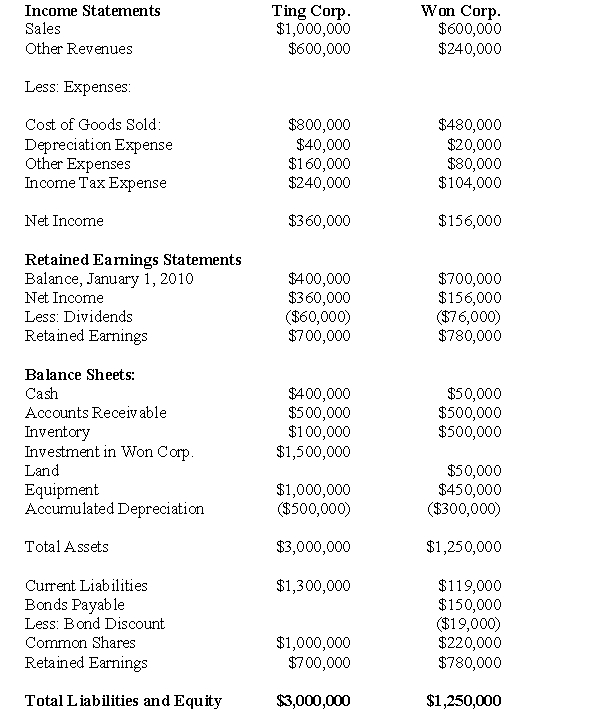

Ting Corp.owns 75% of Won Corp and uses the Cost Method to account for its Investment,which it acquired on January 1,2010 The Financial Statements of Ting Corp and Won Corp for the Year ended December 31,2010 are shown below:  Other Information:

Other Information:

Won sold a tract of land to Ting at a profit of $20,000 during 2010.This land is still the property of Ting Corp.

On January 1,2010,Won sold equipment to Ting at a price that was $20,000 lower than its book value.The equipment had a remaining useful life of 5 years from that date.

On January 1,2010,Won's inventories contained items purchased from Ting for $120,000.This entire inventory was sold to outsiders during the year.Also during 2010,Won sold inventory to Ting for $30,000.Half this inventory is still in Ting's warehouse at year end.All sales are priced at a 20% mark-up above cost,regardless of whether the sales are internal or external.

Won's Retained Earnings on the date of acquisition amounted to $400,000.There have been no changes to the company's common shares account.

Won's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▫ Inventory had a fair value that was $50,000 higher than its book value

▫ A patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $20,000.The patent had an estimated useful life of 5 years.

▫ There was a goodwill impairment loss of $10,000 during 2010

▫ Both companies are subject to an effective tax rate of 40%.

▫ Both companies use straight line amortization exclusively.

▫ On January 1,2010,Ting acquired half of Won's bonds for $60,000

▫ The bonds carry a coupon rate of 10% and mature on January 1,2030.The initial bond issue took place on January 1,2010.The total discount on the issue date of the bonds was $20,000.

▫ Gains and losses from intercompany bondholdings are to be allocated to the two companies when consolidated statements are prepared.

-The amount of goodwill arising from this business combination is

Definitions:

Board Meeting

A formal gathering of the board of directors of an organization, company, or corporation to discuss and decide on company policy and management issues.

Liable

Being legally responsible or obligated.

Sarbanes-Oxley Act

A U.S. federal law that aims to protect investors by making corporate disclosures more reliable and accurate, enhancing financial transparency and accountability.

Audit Committee

A subcommittee of a company's board of directors responsible for overseeing financial reporting, audit processes, and compliance with laws and regulations.

Q13: Ignoring income taxes and any minority interest

Q18: Compute Alcor's Consolidated Retained Earnings as at

Q23: During an acquisition,when should intangible assets NOT

Q24: Assuming that Hanson had no recorded goodwill

Q25: Under the Temporal Method:<br>A)The relationship of balance

Q40: Maude is considering opening her own business,

Q42: Which of the following rates would be

Q44: Accounting information is used to monitor operations

Q68: Company A has made an offer to

Q70: What is the amount of goodwill arising