The following information pertains to questions

Big Guy Inc.purchased 80% of the outstanding voting shares of Humble Corp.for $360,000 on July 1,2001.On that date,Humble Corp had Common Stock and Retained Earnings worth $180,000 and $90,000,respectively.The Equipment had a remaining useful life of 5 years from the date of acquisition.Humble's Bonds mature on July 1,2011.Both companies use straight line amortization,and no salvage value is assumed for assets.The trademark is assumed to have an indefinite useful life.

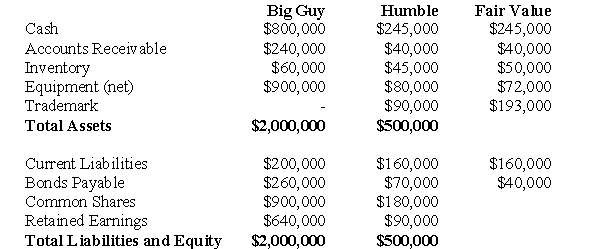

Goodwill is tested annually for impairment.The Balance Sheets of Both Companies,as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

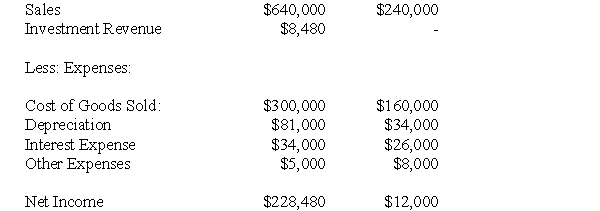

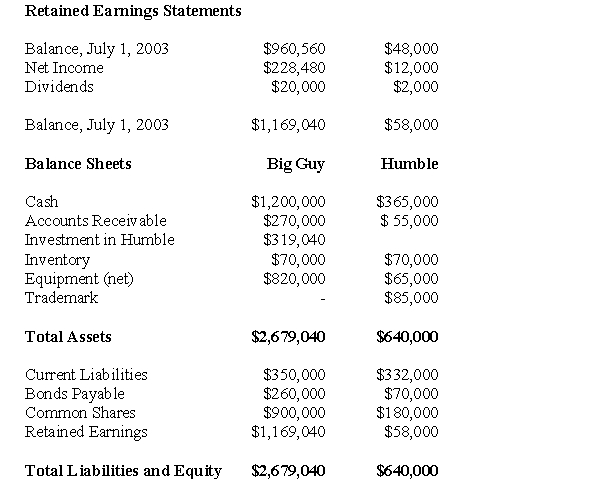

The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

Income Statements:

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

-The amount of bonds payable appearing on Big Guy's Consolidated Balance Sheet on July 1,2004 would be:

Definitions:

Master Production Schedule

A detailed plan that specifies what products are to be made, in what quantities, and when, serving as a primary input in materials requirement planning (MRP).

Time-Phased Schedule

A detailed plan that outlines when specific tasks or activities should start and finish over a set period, often used in project management.

Net Requirements

The total demand for a product minus the inventory currently in stock, used in manufacturing and logistics planning.

Q4: What would be the balance in the

Q8: What amount of interest expense (if any)would

Q12: Which of the following statements is correct?<br>A)Under

Q14: Prepare a Balance Sheet for Clarke on

Q19: Translate Wilsen's December 31,2014 Balance Sheet.

Q26: Section 4430 contains a compromise applicable to

Q32: As an accountant, you are responsible for:<br>I.

Q39: Section 1625 of the CICA Handbook states

Q50: What is the amount of the forward

Q52: Where would the amortization of the acquisition