The following information pertains to questions

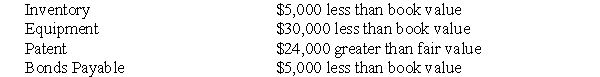

Brand X Inc.purchased a controlling interest in Brand Y Inc.for $200,000 on January 1,2001.On that date,Brand Y Inc had common stock and retained earnings worth $180,000 and $20,000,respectively.Goodwill is tested annually for impairment.At the date of acquisition,Brand Y's assets and liabilities were assessed for fair value as follows:  The Balance Sheets of Both Companies,as at December 31,2001 are disclosed below:

The Balance Sheets of Both Companies,as at December 31,2001 are disclosed below:  The net incomes for Brand X and Brand Y for the year ended December 31,2001 were $1,000 $48,000 respectively.An impairment test conducted on December 31,2001 revealed that the Goodwill should actually have a value $2,000 lower than the amount computed on the date of acquisition.Both companies use a FIFO system,and Brand Y's inventory on the date of acquisition was sold during the year.Brand X did not declare any dividends during the year.However,Brand Y paid $51,000 in dividends to make up for several years in which the company had never paid any dividends.Brand Y's equipment and patent have useful lives of 10 years and 6 years respectively from the date of acquisition.All bonds payable mature on January 1,2006.

The net incomes for Brand X and Brand Y for the year ended December 31,2001 were $1,000 $48,000 respectively.An impairment test conducted on December 31,2001 revealed that the Goodwill should actually have a value $2,000 lower than the amount computed on the date of acquisition.Both companies use a FIFO system,and Brand Y's inventory on the date of acquisition was sold during the year.Brand X did not declare any dividends during the year.However,Brand Y paid $51,000 in dividends to make up for several years in which the company had never paid any dividends.Brand Y's equipment and patent have useful lives of 10 years and 6 years respectively from the date of acquisition.All bonds payable mature on January 1,2006.

-Prepare Brand X's Consolidated Balance Sheet as at December 31,2001,assuming that Brand X purchased 100% of Brand Y for $350,000.

Definitions:

Social Gathering

A social gathering is an event where people come together to interact, engage, or celebrate, often for communal or celebratory purposes.

Grocery Store

A retail store that sells food and household goods, serving as a convenient place for consumers to purchase their daily necessities.

Incremental Mind-Set

The belief that personal attributes, such as intelligence or talent, can be developed or improved over time through effort and perseverance.

Learning-Oriented Goals

The aims or objectives set to acquire new skills or knowledge, focusing on the process of learning rather than the end result.

Q5: Compute the Balance in Hot's Investment in

Q6: Company A owns all of the outstanding

Q19: _. Eggs are a great source of

Q22: What is the amount of unrealized after-tax

Q28: Which of the following journal entries would

Q34: How many categories are there?<br>A) two<br>B) three<br>C)

Q36: Assuming that Parent Inc.purchased 80% of Sub's

Q38: What would be the amount of the

Q57: What is the total amount of deferred

Q110: Which of the sentences in paragraph 2