The following information pertains to questions

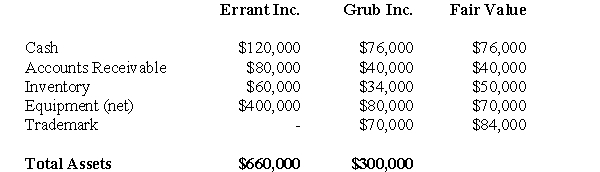

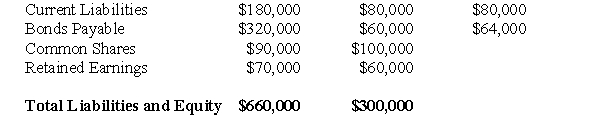

Errant Inc purchased 100% of the outstanding voting shares of Grub Inc.for $200,000 on January 1,2004.On that date,Grub Inc had common stock and retained earnings worth $100,000 and $60,000,respectively.Goodwill is tested annually for impairment.The Balance Sheets of both companies,as well as Grub's fair market values on the date of acquisition are disclosed below:

The net incomes for Errant and Grub for the year ended December 31,2007 were $160,000 and $90,000 respectively.Grub paid $9,000 in Dividends to Errant during the year.There were no other inter-company transactions during the year.Moreover,an impairment test conducted on December 31,2007 revealed that the Goodwill should actually have a value of $20,000.Both companies use a FIFO system,and most of Grub's inventory on the date of acquisition was sold during the year.Errant did not declare any dividends during the year.

The net incomes for Errant and Grub for the year ended December 31,2007 were $160,000 and $90,000 respectively.Grub paid $9,000 in Dividends to Errant during the year.There were no other inter-company transactions during the year.Moreover,an impairment test conducted on December 31,2007 revealed that the Goodwill should actually have a value of $20,000.Both companies use a FIFO system,and most of Grub's inventory on the date of acquisition was sold during the year.Errant did not declare any dividends during the year.

Assume that Errant Inc.uses the Equity Method unless stated otherwise.

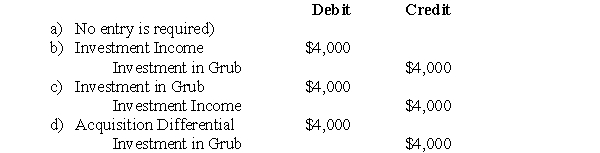

-Which of the following journal entries would be required on December 31,2007 to record the Impairment of the Goodwill?

Definitions:

Gavage-Feeding

The process of feeding a person or an animal through a tube inserted into the stomach, used when oral intake is not possible.

Preterm Newborn

A baby born before 37 weeks of gestation, often requiring specialized care due to underdeveloped organs.

Gravity Flow

The movement of liquids in response to gravity alone, often used in reference to the administration of intravenous fluids or other substances.

Jittery

Feeling anxious or nervous, often exhibiting with physical restlessness.

Q2: The topic sentence of paragraph 3 is<br>A)

Q2: What is the amount of the discount

Q4: This paragraph will be about my family.<br>A)

Q8: Explain why the use of management accounting

Q12: State troopers report that many people do

Q18: Parent Company acquires Sub Company's common shares

Q25: What is the amount of unrealized after-tax

Q35: Cost accounting information is used for:<br>A)Financial reporting

Q42: By what amount (in Canadian Dollars)would ABC

Q104: The Certified Management Accountants of Canada (CMA)Competency