The following information pertains to questions

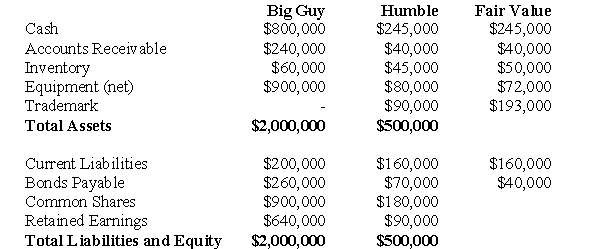

Big Guy Inc.purchased 80% of the outstanding voting shares of Humble Corp.for $360,000 on July 1,2001.On that date,Humble Corp had Common Stock and Retained Earnings worth $180,000 and $90,000,respectively.The Equipment had a remaining useful life of 5 years from the date of acquisition.Humble's Bonds mature on July 1,2011.Both companies use straight line amortization,and no salvage value is assumed for assets.The trademark is assumed to have an indefinite useful life.

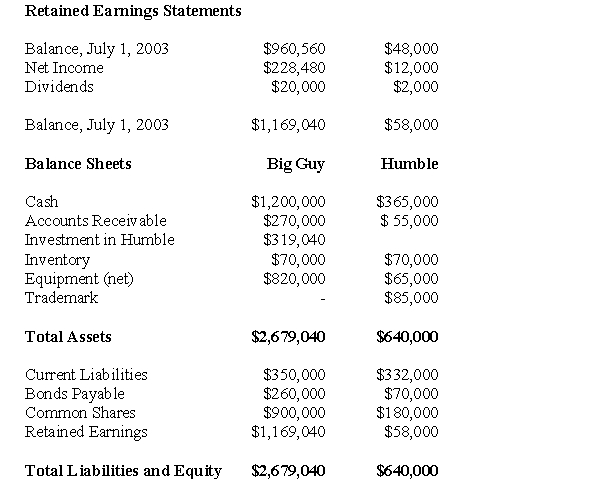

Goodwill is tested annually for impairment.The Balance Sheets of Both Companies,as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

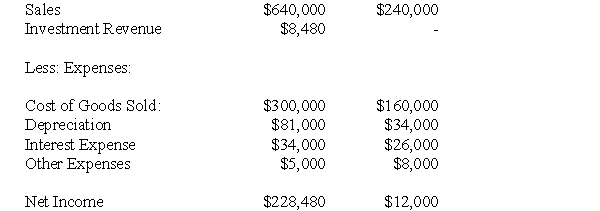

The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

Income Statements:

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

-The amount of depreciation expense appearing on Big Guy's July 1,2004 Consolidated Income Statement would be:

Definitions:

Multiple-hurdle Model

A selection process in which an applicant must successfully pass a series of tests or criteria to move to the next stage of evaluation.

Employment Tests

Assessments used by employers to evaluate a candidate's qualifications, skills, or suitability for a specific job or role.

Broad Categories

General or wide-ranging classifications used to organize content, ideas, objects, or phenomena into groups.

Human Resource Planning

Identifying the numbers and types of employees the organization will require in order to meet its objectives.

Q1: What would be the non-controlling interest amount

Q4: Which of the following types of share

Q8: What is the amount of unrealized after-tax

Q22: How many causes or effects does the

Q31: Which of the following is NOT a

Q40: Subject: reasons to donate money to the

Q55: Translate Martin's 2011 Income Statement into Canadian

Q56: How much Intercompany profit was realized on

Q69: Subject: steps to follow to obtain a

Q88: Slowly reading your revised paragraph or essay