The following information pertains to questions

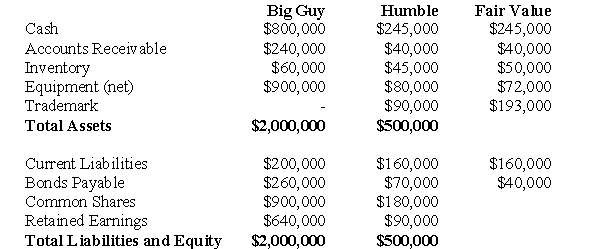

Big Guy Inc.purchased 80% of the outstanding voting shares of Humble Corp.for $360,000 on July 1,2001.On that date,Humble Corp had Common Stock and Retained Earnings worth $180,000 and $90,000,respectively.The Equipment had a remaining useful life of 5 years from the date of acquisition.Humble's Bonds mature on July 1,2011.Both companies use straight line amortization,and no salvage value is assumed for assets.The trademark is assumed to have an indefinite useful life.

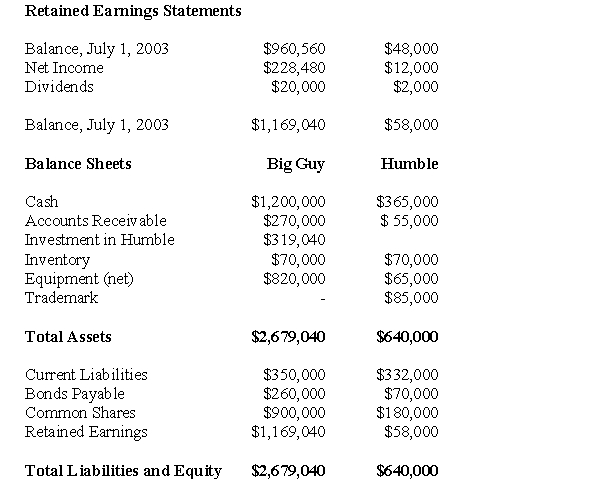

Goodwill is tested annually for impairment.The Balance Sheets of Both Companies,as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

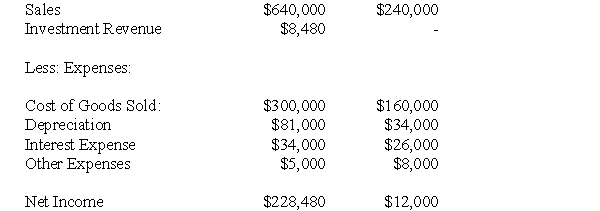

The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

Income Statements:

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

-The amount of Non-Controlling Interest on Big Guy's Consolidated Balance Sheet on July 1,2001 would be:

Definitions:

Introduction

An initial section that leads into the subject matter, providing a preview or context.

Passengers

Individuals or travelers transported on a vehicle such as a plane, train, ship, or bus.

Soap Operas

Television or radio dramas series characterized by serialized narratives, often revolving around personal relationships and emotional drama.

Daytime Melodramas

Television dramas, also known as soap operas, that are typically aired during the day and are characterized by serialized storylines with emotional or sensational themes.

Q6: If the functional currency of the foreign

Q13: Subject: studying in a group versus studying

Q16: Ignoring taxes,what is the total amount of

Q17: Full moons occur twenty-nine days apart.<br>A) a<br>B)

Q25: What is the amount of unrealized after-tax

Q25: Which of the following is true with

Q29: Testing intangible assets with indefinite useful lives

Q37: What is the amount of foreign exchange

Q39: Indicate whether each of the following items

Q42: Subject: _ <br>Audience: people who have never