The following information pertains to questions

Big Guy Inc.purchased 80% of the outstanding voting shares of Humble Corp.for $360,000 on July 1,2001.On that date,Humble Corp had Common Stock and Retained Earnings worth $180,000 and $90,000,respectively.The Equipment had a remaining useful life of 5 years from the date of acquisition.Humble's Bonds mature on July 1,2011.Both companies use straight line amortization,and no salvage value is assumed for assets.The trademark is assumed to have an indefinite useful life.

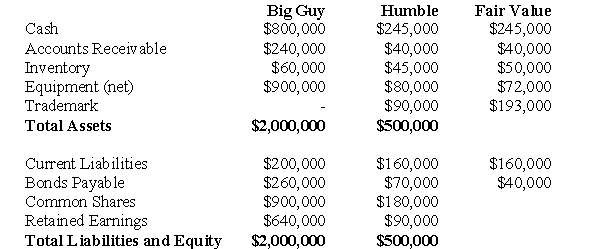

Goodwill is tested annually for impairment.The Balance Sheets of Both Companies,as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

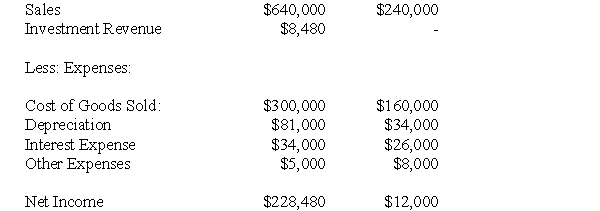

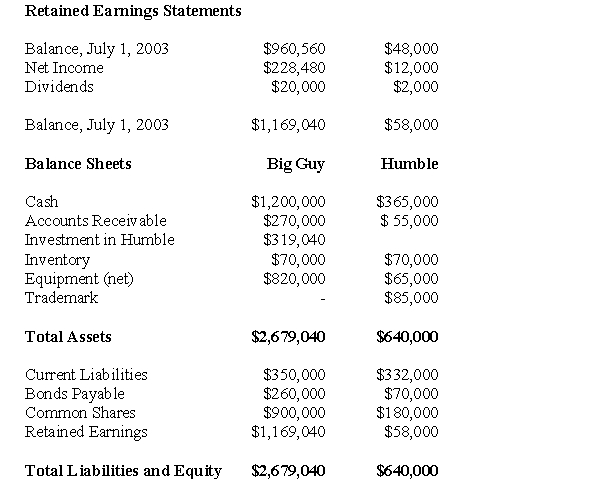

The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

Income Statements:

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

-The amount of non-controlling interest appearing on Big Guy's July 1,2004 Consolidated Income Statement would be:

Definitions:

Unanimous Shareholders' Agreement

An agreement among all shareholders of a corporation, often detailing the management, control, and direction of the corporation's affairs.

No Restrictions

A condition or status where there are no limitations, constraints, or regulations imposed on actions or activities.

Fiduciary Duty

A legal obligation for one party to act in the best interest of another party, such as a trustee for a beneficiary.

Legislative Requirements

Obligations or conditions laid down by law that must be complied with by individuals or organizations.

Q1: Some gains and losses arising on a

Q9: For the sake of simplicity,assume that US1's

Q12: Which of the following statements is FALSE?<br>A)If

Q15: What kind of order is used to

Q17: What writing pattern does this paragraph employ?<br>A)

Q26: Future rap star Onika Tanya Maraj born

Q36: Assuming this Business Combination was to be

Q40: Which of the following journal entries would

Q44: Which of the following journal entries would

Q56: The amount of Accounts Receivable appearing on