The following information pertains to questions

Big Guy Inc.purchased 80% of the outstanding voting shares of Humble Corp.for $360,000 on July 1,2001.On that date,Humble Corp had Common Stock and Retained Earnings worth $180,000 and $90,000,respectively.The Equipment had a remaining useful life of 5 years from the date of acquisition.Humble's Bonds mature on July 1,2011.Both companies use straight line amortization,and no salvage value is assumed for assets.The trademark is assumed to have an indefinite useful life.

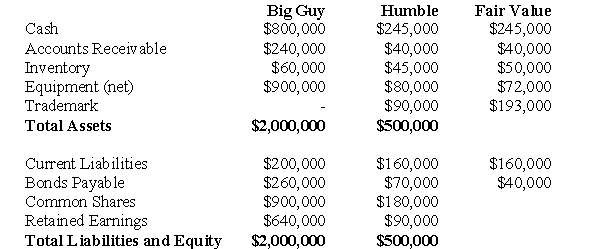

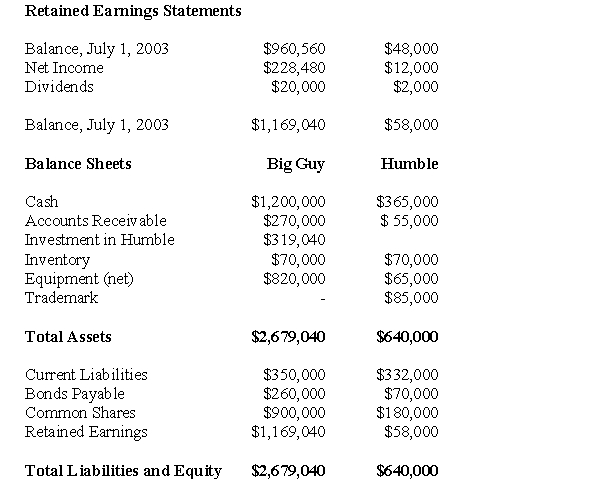

Goodwill is tested annually for impairment.The Balance Sheets of Both Companies,as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

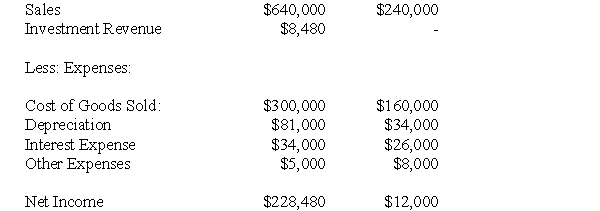

The following are the Financial Statements for both companies for the fiscal year ended July 1,2004:

Income Statements:

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

An impairment test conducted in September 2002 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded) Both companies use a FIFO system,and Humble's entire inventory on the date of acquisition was sold during the following year.During 2004,Humble Inc borrowed $20,000 in Cash from Big Guy Inc.interest free to finance its operations.Big Guy uses the Equity Method to account for its investment in Humble Corp.Assume that the entity method applies.

-Big Guy's Consolidated Retained Earnings for the year ended July 1,2004 would be:

Definitions:

Reflection

The process of introspectively considering one's thoughts, feelings, actions, and outcomes to gain insights or solve problems.

Mirror

A reflective surface, typically of glass coated with a metal amalgam, that reflects a clear image.

Concrete-operational

A stage in Piaget's theory of cognitive development during which children gain the ability to think logically about concrete events.

Abstractions

Simplified representations of complex concepts or real scenarios that highlight their essential characteristics while omitting the irrelevant details.

Q5: (1) Stress negatively affects many different parts

Q6: What is the tax basis of these

Q6: What would be the balance in Yours

Q19: (CMA)Wong Company utilizes both strategic planning and

Q21: Assuming that Davis purchases 100% of Martin

Q30: Which enterprises will need to report under

Q36: The subject of this essay is<br>A) reasons

Q38: What would be the amount of the

Q45: Which of the following statements is correct?<br>A)If

Q62: What is the amount of the Deferred