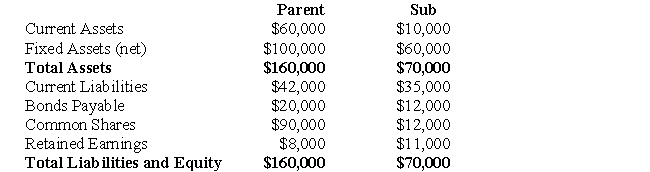

The following data pertains to questions

Parent and Sub Inc had the following balance sheets on December 31,2008:  On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:

On January 1,2009 Parent purchased all of Sub Inc's Common Shares for $40,000 in cash.On that date,Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000,respectively.Assuming that Consolidated Financial Statements were prepared on that date,answer the following:

-The Current Assets of the combined entity should be valued at:

Definitions:

Floor Price

The minimum price level set for a financial security, commodity, or good, below which it cannot be sold in the market.

Convertible Bonds

Convertible bonds are securities that can be turned into a specified amount of equity in the company that issued them, typically at the choice of the person holding the bond, during specific periods of their duration.

Straight-Debt Yield

The return an investor can expect to earn if they hold a bond to maturity without the issuer defaulting, typically not including the effects of callability.

Exchange Ratio

The ratio at which one company’s shares will be exchanged for another in the event of a merger or acquisition.

Q7: What was the pre-tax gain or loss

Q17: We found the answer.<br>A) found, answer<br>B) we,

Q19: What writing pattern does this paragraph employ?<br>A)

Q27: What would be the balance in the

Q30: Clustering is a task that should be

Q31: Which of the following is NOT a

Q35: One of the underlying assumptions of the

Q40: Prepare the journal entries to record the

Q57: The Pooling of Interests Method is no

Q100: One way to fool the brain into