The following data pertains to questions

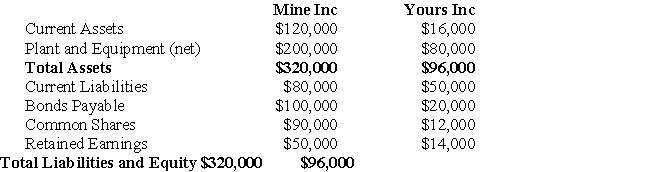

Parent and Sub Inc had the following balance sheets on July 31,2006:  Yours Inc's Book Values were equal to their Fair Values on the date of acquisition,with the exception of Yours' Plant and Equipment,which was worth $100,000.

Yours Inc's Book Values were equal to their Fair Values on the date of acquisition,with the exception of Yours' Plant and Equipment,which was worth $100,000.

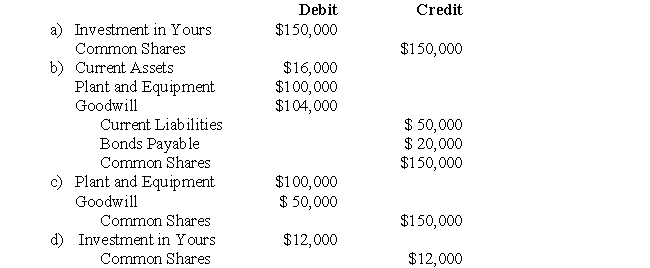

-Assume that Mine Inc issued 10,000 shares for all of Yours Inc's Common Shares.Mine Inc's shares had a fair market value of $15 per share on that date.What entry would be made on Mine Inc's book on that date?

Definitions:

Triceps Brachii

A large muscle on the back of the upper arm responsible for extension of the elbow joint.

Push-Ups

A bodyweight exercise performed by raising and lowering the body using the arms, targeting muscles in the upper body and core.

Supraspinatus

A muscle located in the shoulder, part of the rotator cuff group, aiding in arm lifting and rotation.

Gastrocnemius

A major calf muscle involved in walking, jumping, and running, contributing to the movement of the ankle and knee.

Q5: Which of the following journal entries would

Q9: Of all the _ I've known, George

Q10: Prepare Brand X's Consolidated Balance Sheet as

Q17: Which of the following journal entries would

Q23: What is the amount of CMI's foreign

Q26: On what basis does the writer classify

Q29: One commonly cited weakness of Consolidated Financial

Q32: A company has decided to purchase 100%

Q35: Assuming that Errant uses the Cost Method,what

Q42: By what amount (in Canadian Dollars)would ABC