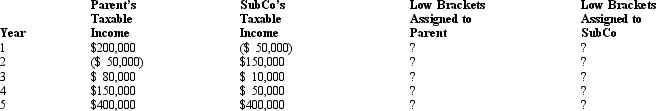

Parent Corporation owns 100% of the stock of SubCo,and the two corporations file a consolidated tax return.Over a five-year period,the corporations generate the following taxable income/(loss).Indicate how you would assign the taxpayers' low marginal rates that apply to the group's first $75,000 of taxable income.Explain the rationale for your recommendation.

Definitions:

Human Resources

The department within an organization that manages recruitment, training, and welfare of employees, ensuring a productive workforce.

Interviewing Candidates

The process of asking questions and evaluating the responses of individuals applying for a position to determine their suitability.

Feedback

Information or thoughts provided as a response to an action, work, or performance, aimed at offering constructive criticism or praise.

Link Generously

The practice of including multiple hyperlinks in digital content to enhance its value and provide readers with additional resources.

Q3: Similar to the like-kind exchange provision,§ 351

Q4: Enhancing R&D is a common reason why

Q5: In the United States target shareholders must

Q6: One of the advantages of an asset

Q25: Yellow Corporation has a deficit in accumulated

Q42: Which of the following is not a

Q71: In 2010,Jay Corporation (a calendar year taxpayer)had

Q78: Over time,the consolidated return rules have shifted

Q78: Shareholders may defer gain,to the point of

Q86: Which of the following statements regarding income