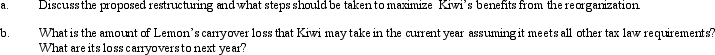

Kiwi Corporation would like to acquire Lemon Corporation on October 31 in a tax-free reorganization.While Kiwi is not interested in Lemon's line of business,Kiwi finds Lemon particularly appealing because Lemon has a $600,000 NOL and $20,000 capital loss carryover.Kiwi is a very profitable corporation and is also expecting to have at least $500,000 of capital gains for the current year.At the time of the restructuring,Lemon has assets valued at $3 million (basis of $3.3 million)and Kiwi could use most of these assets in its business.However,Kiwi would rather sell the assets,recognize the loss to offset its expected gains,and then use the proceeds to purchase new equipment.Kiwi is proposing exchanging 25% of its stock for all of Lemon's assets.The long-term tax-exempt rate is currently 6%,and Kiwi's discount factor for making investment decisions is 10%.

Definitions:

Catholic

Relating to the Roman Catholic Church, its teachings, practices, and beliefs.

Yom Kippur

The holiest day in Judaism, marked by fasting and atonement, observed with intensive prayer and repentance.

Parenterally

The administration of medication or nutrition by injection through routes other than the digestive tract, such as intravenously, intramuscularly, or subcutaneously.

Cardiac Catheterization

A medical procedure used to diagnose and treat cardiovascular conditions by inserting a long, thin tube into a blood vessel and guiding it to the heart.

Q7: Haywood and Hambrick found:<br>A)Horizontal integration yields positive

Q7: In each of the following independent situations,calculate

Q9: Research shows that changing the state of

Q10: Income tax treaties may provide for higher

Q10: Markides and Oyon found positive announcement effects

Q52: Which of the following items will be

Q75: Ten years ago,Connie purchased 4,000 shares in

Q79: Generally,an administrative expense should be claimed on

Q103: In a Federal consolidated group,what is an

Q138: Which of the following statements best describes