Essay

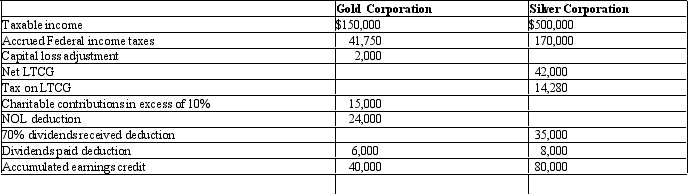

In each of the following independent situations,calculate accumulated taxable income,if any.Assume the corporation is not a mere holding or investment company.

Definitions:

Related Questions

Q7: Corporate taxpayers have a few advantages over

Q12: The LMN Trust is a simple trust

Q17: Where are the controlling Federal income tax

Q24: The Roz Trust has distributable net income

Q44: Carl transfers land to Cardinal Corporation for

Q50: Art,an unmarried individual,transfers property (basis of $130,000

Q51: Coral Corporation declares a nontaxable dividend payable

Q52: In a § 351 transaction,if a transferor

Q111: Audrey made taxable gifts of cash in

Q123: In arriving at the taxable estate,expenses incurred