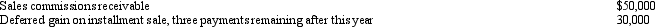

Bob is one of the income beneficiaries of the LeMans Estate,which is subject to a 45% marginal Federal estate tax rate,a 35% marginal Federal income tax rate,and a 5% marginal state income tax rate.This year,Bob received all of the sales commissions that were earned and payable to Violet LeMans (cash basis)at her death.Compute Bob's § 691(c)deduction for the current year,given the following data.

Definitions:

Scope

Refers to the extent or range of an activity, project, or study, outlining its boundaries, deliverables, and limitations.

Purpose

The reason for which something is done or created or for which something exists.

Anticipated Questions

Queries that are expected or predicted based on a particular context or subject matter.

Bibliography

A list of sources, such as books, articles, and documents, that were consulted or referenced in the creation of a piece of writing.

Q3: In each of the following independent situations,describe

Q38: Because of the estate tax deduction,a testamentary

Q51: Explain the expanded affiliated group (EAG)rules.

Q56: During the current year,Yellow Company had operating

Q70: Rohan,Inc. ,a calendar year closely held corporation,is

Q77: The regular foreign tax credit is available

Q87: Herbert leaves one-half of his estate to

Q97: List several key planning ideas with respect

Q102: Even though it results in more estate

Q103: The IRS uses document matching programs to