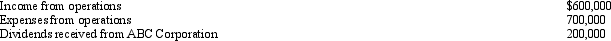

During the current year,Quartz Corporation (a calendar year C corporation)has the following transactions:

Quartz owns 25% of ABC Corporation's stock.How much is Quartz Corporation's taxable income (loss)for the year?

Definitions:

Incompetence

A lack of ability, legal qualifications, or fitness to discharge required duties or tasks.

Ethical Codes

Sets of guidelines and principles designed to direct the conduct of members of a profession or organization.

Model Rules

A set of ethical guidelines adopted by the American Bar Association for attorneys and legal professionals, aiming to establish a standard for ethical legal practice.

Professional Conduct

Ethical and professional standards expected of professionals, including adherence to laws, regulations, and practices that define acceptable behavior in their respective fields.

Q2: Beige Corporation,a C corporation,purchases a warehouse on

Q15: Arlene,an advertising executive,pays a contractor to build

Q42: For the IRS to grant a discretionary

Q53: Jose receives a nontaxable distribution of stock

Q56: During the current year,Yellow Company had operating

Q73: A farm has a best use valuation

Q73: During 2010,Brown Corporation (a calendar year taxpayer)has

Q80: At the beginning of the current year,Dan

Q92: In most states,a limited liability company (LLC)is

Q103: The IRS uses document matching programs to