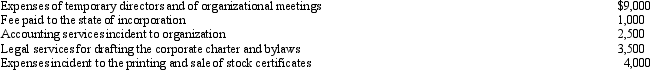

Emerald Corporation,a calendar year C corporation,was formed and began operations on July 1,2010.The following expenses were incurred during the first tax year (July 1 through December 31,2010) of operations:

Assuming a § 248 election,what is the Emerald's deduction for organizational expenditures for 2010?

Definitions:

Moral Standards

Principles that govern behavior, distinguishing between acceptable and unacceptable actions within a society or group.

Adolescents

The transitional stage from childhood to adulthood, typically involving individuals aged between 13 and 19 years.

Elaborative Strategy

A method for increasing retention of new information by relating it to well-known information.

Rote Rehearsal

A memorization technique that involves repeating information over and over again to embed it in memory.

Q16: Falcon Corporation has $200,000 of current E

Q40: Distribution of an appreciated asset triggers immediate

Q46: Kirby and Helen form Red Corporation.Kirby transfers

Q50: Quail Corporation is a C corporation with

Q60: Which,if any,of the following is not a

Q63: If a distribution of stock rights is

Q84: Boasso Corporation manufactures an exercise machine at

Q86: Bear Corporation has a net short-term capital

Q108: Max (a calendar year taxpayer)donates a painting

Q117: A Federal gift tax return need not