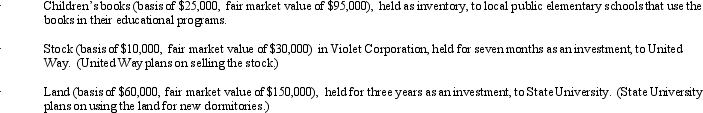

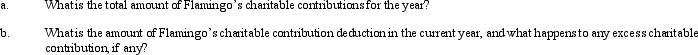

During the current year,Flamingo Corporation,a regular corporation in the book publishing business,made charitable contributions to qualified organizations as follows:

Flamingo Corporation's taxable income (before any charitable contribution)is $1 million.

Definitions:

Variables

Elements, features, or factors that are likely to vary or change and can be measured in an experiment or model.

Services Inventory

The concept of quantifying and managing the availability of intangible service capacities, such as hours of labor or access to resources.

Graphical Method

A visual approach to solving mathematical or analytical problems using diagrams, charts, or graphs.

Aggregate Planning

A process by which a company determines levels of capacity, production, subcontracting, inventory, stockouts, and pricing over a specified time horizon.

Q5: When depreciable property is transferred to a

Q8: Beneficiary Terry received $40,000 from the Urgent

Q11: The special use valuation method of §

Q19: A recapture of special use valuation will

Q31: Concerning the penalty for civil fraud applicable

Q39: Rob and Sharon form Swallow Corporation with

Q77: Lynn transfers property (basis of $225,000 and

Q81: Nancy,Guy,and Rod form Goldfinch Corporation with the

Q81: Two brothers,Sam and Bob,acquire real estate as

Q113: Two years prior to death,a decedent makes