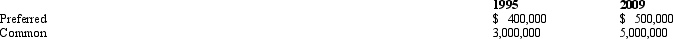

Dustin owns all of the stock of Gold Corporation which includes both common and preferred shares.The preferred stock is noncumulative,has no redemption date,and possesses no liquidation preference.In 1995,Dustin makes a gift to his adult children of all of the common stock.He dies in 2009 still owning the preferred stock.The value of the Gold stock on the relevant dates is:

One of the tax consequences of this estate freeze is:

Definitions:

Retina

The light-sensitive layer of tissue at the back of the inner eye that converts light images into neural signals sent to the brain.

Central Nervous System

The part of the nervous system consisting of the brain and spinal cord, responsible for integrating sensory information and responding accordingly.

Neural Tissue

Neural tissue refers to the specialized cells and biological material that make up the nervous system, including the brain, spinal cord, and nerves, facilitating the transmission of electrical signals throughout the body.

Colour Vision

The ability of the eye and brain to perceive differences in wavelengths of light, enabling humans and other animals to see a variety of colors.

Q29: Jane and Walt form Yellow Corporation.Jane transfers

Q41: Beth forms Lark Corporation with a transfer

Q50: Quail Corporation is a C corporation with

Q51: Peggy,a trustee,has learned that the Olsen Trust

Q62: In connection with a traditional IRA that

Q78: If an organization qualifies for exempt status

Q85: The key factor in determining whether an

Q96: You are completing the State A income

Q102: Mickey,a calendar year taxpayer,was not required to

Q143: The U.S.has death tax conventions (i.e. ,treaties)with