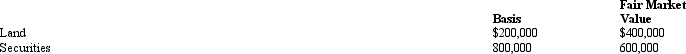

Curt owns the following assets which he gives to his daughter Carla in 2009 (no gift tax results) .

Both items have been held by Curt as an investment for more than one year.If Carla immediately sells these assets for $1 million ($400,000 + $600,000) ,she recognizes:

Definitions:

Equivalent

Identical in worth, quantity, role, significance, or rank.

Equivalent Values

Items or amounts that are equal in value, function, or meaning.

Scheduled

Planned or arranged for a specific time or sequence of events.

Two-Month Intervals

Time periods that occur or are calculated every two months.

Q1: Eileen transfers property worth $200,000 (basis of

Q5: In January 2009,Clint makes a gift of

Q7: An exempt organization can be subject to

Q9: Under P.L.86-272,the taxpayer is exempt from state

Q22: Warren sells property that he inherited five

Q54: In 2008,Sophia sold real estate (adjusted basis

Q56: During the current year,Yellow Company had operating

Q62: Harry,the sole income beneficiary,received a $40,000 distribution

Q75: Which of the following procedures carried out

Q134: A lifetime transfer that is supported by