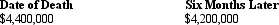

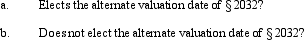

Merwin and Phyllis have always lived in a community property state.At the time of Merwin's prior death in 2009,they held land that cost them $600,000 but was valued as follows.

Under Merwin's will,his half of the land passes to their daughter,Grace.What income tax basis will Phyllis and Grace have in the land,if Merwin's estate:

Definitions:

Screening

A preliminary or indicating procedure.

Menstrual Period

The phase of the menstrual cycle during which bleeding from the uterus occurs through the vagina, marking the shedding of the uterine lining, typically lasting between three to seven days.

Female Patients

Refers to individuals seeking medical care who identify as female.

Cholecystogram

An imaging test that examines the gallbladder for stones, inflammation, or other abnormalities, typically using X-ray after dye ingestion.

Q11: If a corporation is thinly capitalized,all debt

Q12: Latrelle prepares the tax return for Whitehall

Q21: Which statement is false?<br>A)The starting point for

Q30: The Edgerton Estate generated distributable net income

Q47: The grantor set up a trust,income to

Q55: For most taxpayers,which of the traditional apportionment

Q67: What are the tax consequences if an

Q94: Compute the undervaluation penalty for each of

Q106: The purpose of the excise tax imposed

Q120: Which of the following is a requirement