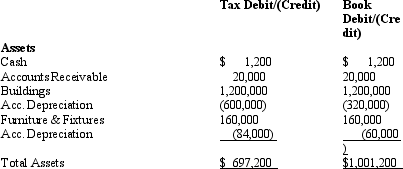

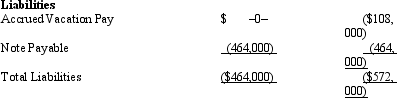

Amelia,Inc. ,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.

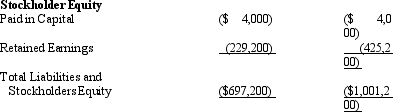

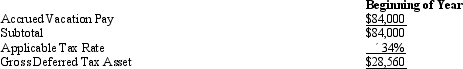

Amelia Inc.'s gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

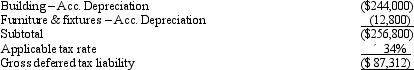

Amelia Inc.'s book income before tax is $25,200.Amelia has two permanent differences between book and taxable income.It earned $1,000 in tax exempt municipal bond interest and had $1,840 in nondeductible meals and entertainment expense.Determine the change in Amelia's deferred tax liabilities for the current year.

Definitions:

Matthias Schleiden

A German botanist and co-founder of cell theory, who in 1838 proposed that all plant tissues are composed of cells and that plant growth results from the production and expansion of these cells.

Anton Van Leeuwenhoek

A Dutch scientist known as the "Father of Microbiology" for his pioneering work in the development of the microscope and the discovery of microbial life.

Theodor Schwann

A German physiologist who co-founded the cell theory, stating that all living things are made up of cells.

Prokaryotic Cell

A simple, single-celled organism without a nucleus or other membrane-bound organelles, such as bacteria and archaea.

Q8: When a practitioner discovers an error in

Q16: If the partnership properly makes an election

Q23: The LMO Partnership distributed $30,000 cash to

Q36: The U.S.Tax Court has 16 regular judges,and

Q48: Collins,Inc.reports an effective tax rate in its

Q53: At the time of her death,Hailey was

Q55: IRS letter rulings seldom are revised or

Q82: How may an S corporation manage its

Q82: For income tax purposes,proportionate and disproportionate distributions

Q96: You are completing the State A income