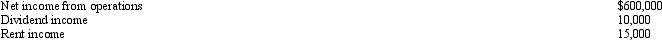

Tuna,Inc. ,a closely held corporation which is not a PSC,owns a 40% interest in Trout Partnership,which is classified as a passive activity.Trout's taxable loss for the current year is $200,000.During the year,Tuna receives a $60,000 cash distribution from Trout.Other relevant data for Tuna are as follows:

How much of Tuna's share of Trout's loss may it deduct in calculating its taxable income?

Definitions:

Dopamine Infusion

A medical treatment involving the continuous intravenous administration of dopamine to support heart function and blood pressure.

Shock

A critical condition brought on by a sudden drop in blood flow through the body, leading to failure of organ systems.

DE-style Equations

Differential equations following specific styles or methods used in mathematical or engineering problems.

Infusion Rates

The speed at which drugs or fluids are delivered intravenously to a patient, typically regulated to ensure proper therapeutic effects.

Q19: George is running for mayor of Culpepper.The

Q35: Which provision is not justified by social

Q51: Music,Inc. ,a domestic corporation,owns 100% of Vinyl,Ltd.

Q51: Which statement is false?<br>A)An S corporation is

Q64: Rhoda,a calendar year individual taxpayer,files her 2008

Q68: In a liquidating distribution,a partnership must distribute

Q75: A partner has a profit-sharing percent,a loss-sharing

Q96: You are completing the State A income

Q109: Post-termination distributions that are charged against OAA

Q110: Yin-Li is the preparer of the Form