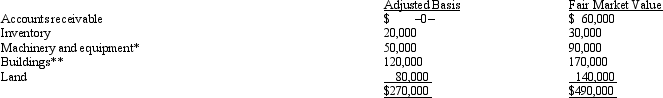

Mr.and Ms.Smith's partnership owns the following assets:

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Mr) and Ms.Smith each have a basis for their partnership interest of $135,000.Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

Definitions:

Financial Metrics

Quantitative measures used to assess the financial health, performance, and condition of a business, aiding in decision-making and strategy formulation.

Profit-Leverage Effect

A financial principle indicating that a decrease in operating costs can have a more significant impact on profits than an equivalent increase in sales revenue.

Purchase Spend

Purchase spend refers to the total amount of money a company expends on acquiring goods and services necessary for its operations.

Price Negotiations

entail bargaining between buyers and sellers to reach mutually agreeable terms for the price of goods or services.

Q5: Julie owns property that is treated as

Q28: Which of the following is one of

Q35: Which of the following is a correct

Q40: The adoption tax credit can be explained

Q59: Which statement is incorrect with respect to

Q67: Our basic approach to criminal justice research

Q67: A deferred tax asset is the current

Q73: Which of the following entities has limited

Q97: The excise taxes such as the tax

Q111: Of the five types of entities,only the