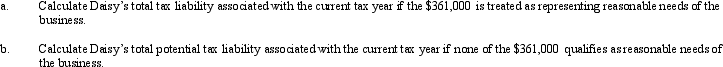

Daisy,Inc. ,has taxable income of $850,000 during 2010,its first year of operations.Daisy distributes dividends of $200,000 to its 10 shareholders (i.e. ,$20,000 each).Daisy earmarks $361,000 of its earnings for potential future expansion into other cities.

Definitions:

Tobacco Use

The act of consuming tobacco products, such as cigarettes, cigars, or chewing tobacco, often associated with numerous health risks, including cancer and cardiovascular diseases.

Short-term Consequences

Immediate, often temporary effects that follow an action or decision.

Long-term Consequences

The far-reaching effects or outcomes of an action, condition, or disorder that manifest over an extended period.

Harm Reduction

Strategies and approaches aimed at minimizing the negative health, social, and legal impacts associated with behavior, such as drug use, that cannot be completely stopped.

Q4: Which item may override an Internal Revenue

Q16: Quantitative research is of a higher order

Q24: Nina and Sue form an equal partnership

Q37: PaintCo Inc. ,a domestic corporation,owns 100% of

Q44: A limited liability company:<br>A)Is subject to double

Q47: The Statements on Standards for Tax Services

Q61: A C corporation offers greater flexibility in

Q73: Henrietta has hired Gracie,a CPA,to complete this

Q84: During the current year,John and Ashley form

Q127: Brenda contributes appreciated property to her business