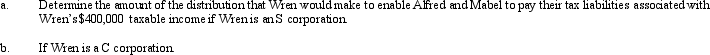

Wren,Inc.is owned by Alfred (30%)and Mabel (70%).Alfred's marginal tax rate is 25% and Mabel's marginal tax rate is 33%.Wren's taxable income for 2010 is $400,000.

Definitions:

GDP Price Index

An economic metric that accounts for inflation by converting output measured at current prices into constant-dollar GDP.

Fixed-Weight Price Index

A method of calculating inflation or deflation that uses predetermined weights for different categories of goods and services, regardless of their current market importance.

Chain-Weighted System

An inflation measure that adjusts the weights from year to year in calculating a price index, thereby reducing the bias caused by a fixed-price weighting system.

Nominal Gross Domestic Product (GDP)

The market value of all goods and services produced within a country in a given period, measured without adjusting for inflation.

Q11: Unless the "widely available" provision is satisfied,a

Q22: In a proportionate nonliquidating distribution of a

Q30: Typical indicators of nexus include the presence

Q38: State D has adopted the principles of

Q42: A deferred tax liability represents a current

Q47: Apple,Inc. ,a cash basis S corporation in

Q49: Which of the following special allocations are

Q77: An S election is made on Form

Q79: For Federal income tax purposes,taxation of S

Q90: A church is not required to obtain