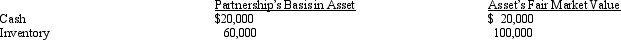

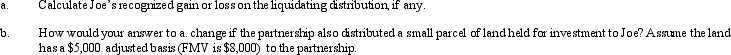

Joe has a 25% capital and profits interest in the calendar-year GDJ Partnership.His adjusted basis for his partnership interest on October 15 of the current year is $200,000.On that date,the partnership liquidates and makes a proportionate distribution of the following assets to Joe.

Definitions:

Holder in Due Course

A person who has acquired a negotiable instrument in good faith and for consideration, and thus has certain rights above the original parties to the instrument.

Executive

A high-ranking official or administrator within an organization, often responsible for making significant decisions and policies.

Liable for Payment

Being legally responsible for covering a debt or financial obligation.

Forged Signature

A signature that has been illegally copied or fabricated without the authorized person's consent.

Q8: Beach,Inc. ,a domestic corporation,owns 100% of Mountain,Ltd.

Q33: Which of the following was not identified

Q33: Cardinal,LLC incurred $20,000 of startup expenses,$3,000 of

Q46: Which of the following lack a fully

Q52: The tax treatment of S corporation shareholders

Q56: The valuation allowance can reduce a deferred

Q63: Syndication costs arise when partnership interests are

Q84: Colin and Reed formed a business entity

Q86: Where the S corporation rules are silent,partnership

Q114: You are a 60% owner of an