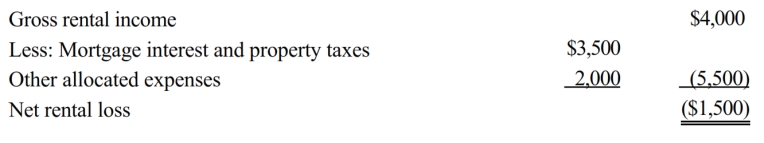

Bob and April own a house at the beach. The house was rented to unrelated parties for 8 weeks during the year. April and the children used the house 12 days for their vacation during the year. After properly dividing the expenses between rental and personal use, it was determined that a loss was incurred as follows:

What is the correct treatment of the rental income and expenses on Bob and April's joint income tax return for the current year assuming the IRS approach is used if applicable?

Definitions:

Market Risk

The possibility of an investor experiencing losses due to factors that affect the overall performance of the financial markets.

Diversification

A risk management strategy that mixes a wide variety of investments within a portfolio to minimize the impact of any single asset's performance on the overall portfolio returns.

Rule Of 70

A quick formula used to estimate the number of years required for an investment or population to double, calculated by dividing 70 by the annual growth rate.

Interest Rate

The cost of borrowing money or the return earned on investments, typically expressed as a percentage of the principal amount.

Q29: Are there any exceptions to the rule

Q38: If a taxpayer has a business with

Q45: Ben was hospitalized for back problems. While

Q57: The basis of an asset on which

Q73: Which of the following is not allowed

Q76: A taxpayer must use the alternative depreciation

Q85: If a vacation home is classified as

Q93: Nicole's employer pays her $150 per month

Q93: Our tax laws encourage taxpayers to assets

Q94: Mindy paid an appraiser to determine how