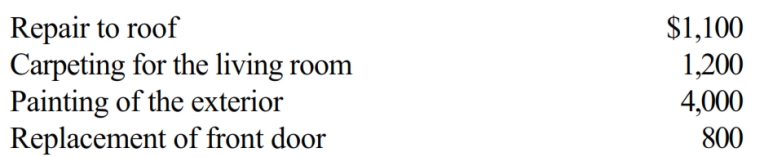

Marvin spends the following amounts on a house he owns:

a. How much of these expenses can Marvin deduct if the house is his principal residence?

b. How much of these expenses can Marvin deduct if he rents the house to a tenant?

c. Classify any deductible expenses as deductions for AGI or as deductions from AGI.

Definitions:

Centralization

Centralization refers to the concentration of decision-making authority and control at the top levels of an organizational hierarchy.

Decision Making

The process of selecting a course of action from multiple alternatives to achieve a desired outcome.

Divisionalized Form

A type of organizational structure where operations are separated into semi-autonomous units or divisions, each responsible for its own performance.

Centralized Form

An organizational structure where decision-making authority is concentrated at the top levels, with little autonomy given to lower levels.

Q8: In meeting the criteria of a qualifying

Q21: Maria made significant charitable contributions of capital

Q35: When Betty was diagnosed as having a

Q49: Office Palace, Inc., leased an all-in-one printer

Q53: A daughter-in-law who lives with taxpayer.

Q56: On June 2, 2017, Fred's TV Sales

Q70: Joe, a cash basis taxpayer, took out

Q106: In terms of the tax formula applicable

Q125: Which of the following miscellaneous expenses is

Q154: An advance payment received in June 2018