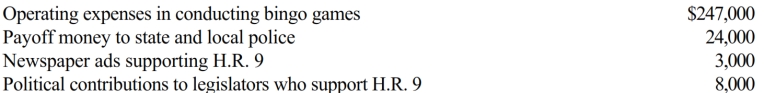

Rex, a cash basis calendar year taxpayer, runs a bingo operation which is illegal under state law. During 2018, a bill designated H.R. 9 is introduced into the state legislature which, if enacted, would legitimize bingo games. In 2018, Rex had the following expenses:

Of these expenditures, Rex may deduct:

Definitions:

Laboratory Examination

A clinical test conducted in a laboratory to analyze samples and diagnose conditions.

Anesthetic

A substance used to induce anesthesia, temporarily eliminating sensation or pain in a part or the entirety of the body.

Needle Holder

Instrument used to hold a suture needle during the suturing process.

Sterile Field

A designated area, such as in a surgical environment, that is kept free of all microorganisms to reduce the risk of infection.

Q2: Bob and April own a house at

Q9: The only asset Bill purchased during 2018

Q22: Ted and Alice were in the process

Q24: Turner, Inc., provides group term life insurance

Q49: During 2018, Lisa (age 66) furnished more

Q74: In 2018, Juan, a cash basis taxpayer,

Q79: Brooke works part-time as a waitress in

Q82: Randy is the manager of a motel.

Q88: If startup expenses total $53,000, $51,000 of

Q95: The IRS will issue advanced rulings as