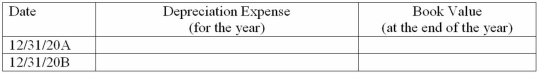

Sutter Company purchased a machine on January 1,20A,for $16,000.The machine has an estimated useful life of 5 years and a $1,000 residual value.It is now December 31,20B,and Sutter is in the process of preparing financial statements.Complete the following schedule assuming declining-balance method of depreciation with a 150% acceleration rate.

Definitions:

Major Increase

Signifies a significant or substantial rise in quantity, level, or intensity of a particular phenomenon or entity.

School Achievement

The measure of a student's academic progress and performance in an educational setting.

Academic Bottom Half

Refers to students who perform below the median in academic achievement in a given population.

Special/Remedial Education

Tailored educational programs designed to meet the needs of learners who require extra support to achieve academic success.

Q6: Chapter 1 cites three reasons for ensuring

Q17: The records of Tea Time Company show

Q25: To be persuasive, proposal writers must demonstrate

Q33: Martinelli Company recently purchased a truck.The price

Q35: To what does a pronoun need to

Q62: The income statement is a "profit statement,"

Q90: For most merchandisers and manufacturers,the required revenue

Q130: Because of depreciation,the net carrying amount of

Q134: An overstatement of the ending inventory causes

Q136: At the end of 20B,SAS Company failed