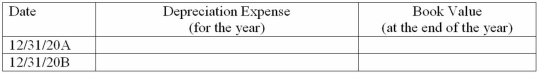

Sutter Company purchased a machine on January 1,20A,for $16,000.The machine has an estimated useful life of 5 years and a $1,000 residual value.It is now December 31,20B,and Sutter is in the process of preparing financial statements.Complete the following schedule assuming declining-balance method of depreciation with a 150% acceleration rate.

Definitions:

S Corporations

A type of corporation in the United States that allows profits, and some losses, to be passed directly to owners' personal income without being subject to corporate tax rates.

Limited Liability Companies

Business entities that offer their owners limited personal liability for the debts and actions of the company while enabling profit distributions.

Q14: When ending inventory is smaller than beginning

Q15: You are writing an internal proposal to

Q17: Which of the following statements is true?<br>A)Accumulated

Q17: Chapter 15 lists four ways to look

Q18: An inappropriate choice in which of following

Q25: Depreciation and depletion conceptually are different because

Q29: In which situation might you present your

Q30: A solicited proposal is one that you

Q36: Chapter 15 lists four questions you should

Q37: Which of the following statements about plain-text