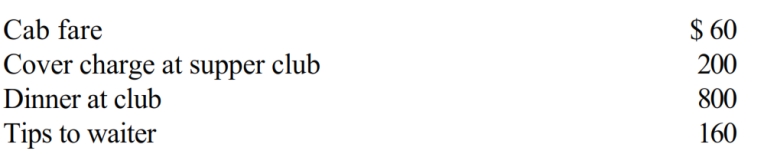

Robert entertains several of his key clients on January 1 of the current year. Expenses paid by Robert are as follows:

Presuming proper substantiation, Robert's deduction is:

Definitions:

Corrective Eye Surgery

Surgical procedures that aim to correct vision problems, such as nearsightedness, farsightedness, or astigmatism, to reduce dependency on glasses or contact lenses.

Visually Distinguish

The ability to identify and differentiate objects or elements based on visual cues and characteristics.

Immanuel Kant

An 18th-century German philosopher known for his critical philosophy, especially his critique of pure reason and moral philosophy.

Gestalt Psychologists

Scholars who study the human mind and behavior as a whole, rather than breaking it down into parts, emphasizing the idea that "the whole is greater than the sum of its parts."

Q6: Ralph made the following business gifts during

Q49: Margaret is trying to decide whether to

Q60: Caroyl made a gift to Tim of

Q62: Rex, a cash basis calendar year taxpayer,

Q63: Phil and Audrey, husband and wife, both

Q84: Discuss the requirements in order for startup

Q119: In 2017, Gail had a § 179

Q126: If a vacation home is classified as

Q218: Ben sells stock (adjusted basis of $25,000)

Q278: Pat owns a 1965 Ford Mustang which