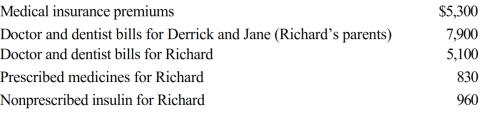

Richard, age 50, is employed as an actuary. For calendar year 2018, he had AGI of $130,000 and paid the following medical expenses:

Derrick and Jane would qualify as Richard's dependents except that they file a joint return. Richard's medical insurance policy does not cover them. Richard filed a claim for $4,800 of his own expenses with his insurance company in November 2018 and received the reimbursement in January 2019. What is Richard's maximum allowable medical expense deduction for 2018?

Definitions:

Self-Serving Bias

A common cognitive bias that causes individuals to attribute positive outcomes to their own characteristics and negative outcomes to external factors.

Fundamental Attribution Error

A cognitive bias that leads people to overemphasize personal traits and underestimate situational factors when explaining others' behaviors.

Self-Serving Bias

A cognitive bias that involves attributing successes to internal factors and failures to external factors to maintain self-esteem.

Penalty Shot

A free shot granted as a result of a violation of rules, specifically in sports like soccer and hockey, with only the shooter and goalkeeper involved in the attempt.

Q25: A taxpayer who meets the age requirement

Q27: Maple Company purchases new equipment (7-year MACRS

Q36: Discuss the tax implications of a seller

Q50: For tax purposes, a statutory employee is

Q53: On May 2, 2018, Karen placed in

Q67: If Wal-Mart stock increases in value during

Q111: Which of the following correctly reflects current

Q113: In the current year, Louise invests $50,000

Q142: Under the actual expense method, which, if

Q199: The amount of the loss basis of