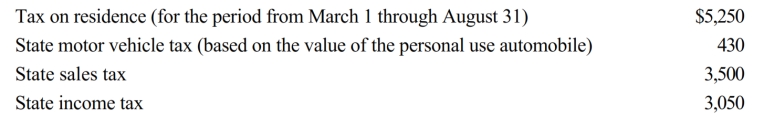

Nancy paid the following taxes during the year:

Nancy sold her personal residence on June 30 of this year under an agreement in which the real estate taxes were not prorated between the buyer and the seller. What amount qualifies as a deduction from AGI for Nancy?

Definitions:

Copper-Alloy Heads

Sculptural heads made from copper alloys, such as bronze, commonly found in various ancient cultures and used for both religious and decorative purposes.

Shrine Doors

The entryways to a shrine, often elaborately designed or decorated, serving as a threshold to a sacred or holy interior.

Yoruba Sculptor

An artist belonging to the Yoruba people, predominantly found in Nigeria, known for their highly stylized and often spiritually significant sculptures.

Olowe Of Ise

A celebrated Yoruba artist from Nigeria, known for his masterful wood carvings and sculptures crafted in the early 20th century.

Q4: If an individual is ineligible to make

Q20: Under the MACRS straight-line election for personalty,

Q22: On January 15, 2018, Vern purchased the

Q26: In 2018, Wally had the following insured

Q53: Sally is an employee of Blue Corporation.

Q67: On July 15, 2018, Mavis paid $275,000

Q102: Qualified moving expenses of an employee that

Q123: A deduction for parking and other traffic

Q144: The services are performed at Sue's premises.

Q152: Lloyd, a practicing CPA, pays tuition to