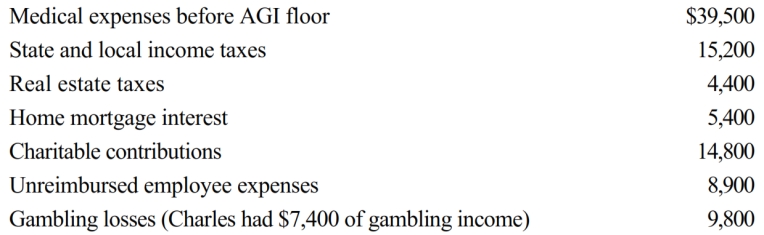

Charles, who is single and age 61, had AGI of $400,000 during 2018. He incurred the following expenses and losses during the year.

Compute Charles's total itemized deductions for the year.

Definitions:

Tachycardia

A condition that involves a heart rate that is abnormally fast.

Brachiocephalic

Pertaining to the brachiocephalic artery or vein, which are major blood vessels in the neck and upper chest that supply blood to the head, neck, and arms.

Cephalic

Relating to or located on the head.

Brachial

Pertaining to the arm, specifically the area of the upper arm close to the shoulder.

Q6: Ralph made the following business gifts during

Q14: In 2018, George and Martha are married

Q42: Maria traveled to Rochester, Minnesota, with her

Q54: The key date for calculating cost recovery

Q61: Flamingo Corporation furnishes meals at cost to

Q61: Dennis, a calendar year taxpayer, owns a

Q70: An individual may deduct a loss on

Q110: In 2018, Liam invested $100,000 for a

Q179: Pam exchanges a rental building, which has

Q236: For the following exchanges, indicate which qualify