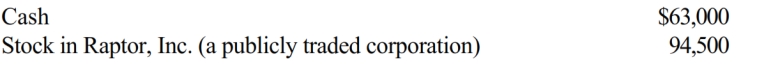

During the current year, Ralph made the following contributions to the University of Oregon (a qualified charitable organization) :

Ralph acquired the stock in Raptor, Inc., as an investment fourteen months ago at a cost of $42,000. Ralph's AGI for the year is $189,000. What is Ralph's charitable contribution deduction for the current year?

Definitions:

M-Form

Stands for the Multidivisional Form, a type of organizational structure where a company is divided into semi-autonomous units or divisions, each with its own responsibilities for profit and loss.

Bureaucracy

An organizational structure characterized by standardized procedures, hierarchy of authority, and formalized rules, often in governmental or large organizations.

Mechanistic Organization

A type of organizational structure that is hierarchical and bureaucratic, emphasizing a clear chain of command, specialized tasks, and centralized decision making.

Organic Organization

A flexible and informal organizational structure that allows for quick adaptation to changes, characterized by low levels of hierarchy and high levels of horizontal communication.

Q5: Terry owns Lakeside, Inc. stock (adjusted basis

Q38: Alice owns land with an adjusted basis

Q50: Marsha transfers her personal use automobile to

Q70: An individual may deduct a loss on

Q87: Alicia was involved in an automobile accident

Q88: If startup expenses total $53,000, $51,000 of

Q92: A taxpayer can carry back any NOL

Q117: Noelle owns an automobile which she uses

Q129: Annette purchased stock on March 1, 2018,

Q146: The stock of Eagle, Inc. is owned