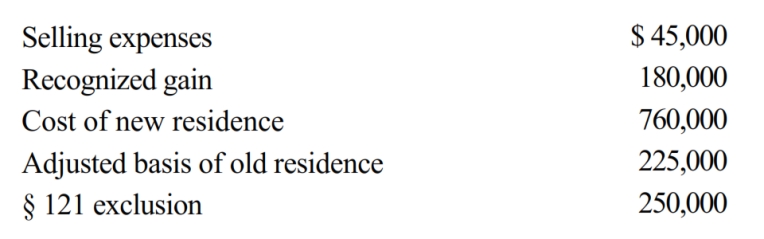

Use the following data to determine the sales price of Etta's principal residence and the realized gain. She is not married. The sale of the old residence qualifies for the § 121 exclusion.

Definitions:

Receivables

Money owed to a company by its customers or other parties for goods and services provided on credit.

Inventories

Assets held for sale in the ordinary course of business, in the process of production for such sale, or in the form of materials or supplies to be consumed in the production process or in the rendering of services.

Credit Risk Analysis

The process of evaluating the likelihood that a lender may not receive the owed principal and interest, which leads to an interruption of cash flows and increased costs for collecting funds.

Financial Ratios

Quantitative measures derived from financial statement analysis used by investors and analysts to assess a company's performance, liquidity, profitability, and solvency.

Q8: The chart below describes the § 1231

Q19: Purchased goodwill is assigned a basis equal

Q44: Qualified business income (QBI) is defined as

Q49: Gray Company, a closely held C corporation,

Q66: Identify the statement below that is false.<br>A)

Q75: A painting is acquired by an individual

Q115: Lindsey, an attorney, earns $125,000 from her

Q117: An individual taxpayer has the gains and

Q117: Noelle owns an automobile which she uses

Q136: In a nontaxable exchange, the replacement property