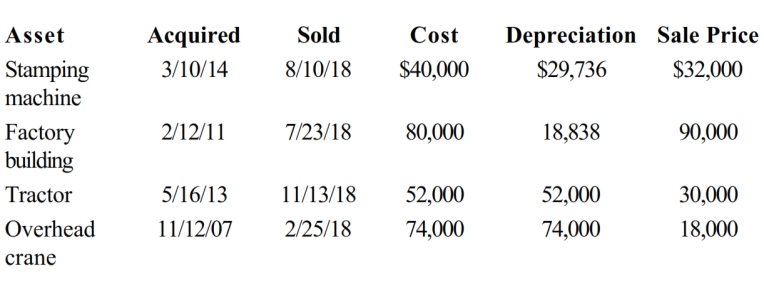

The chart below describes the § 1231 assets sold by the Ecru Company (a sole proprietorship) this year. Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year. Assume there is a § 1231 lookback loss of $4,000.

Definitions:

Special Status

A designation that grants a particular group or region unique rights or privileges, often in a legal or political context.

American Indians

Indigenous peoples of the United States, also known as Native Americans, with diverse cultures, histories, and governments.

Learning Disability

A neurological disorder affecting the brain's ability to receive, process, store, and respond to information, impacting learning.

Middle-Class

A social class between the upper class and working class, including professional and business workers and their families.

Q5: Terry owns Lakeside, Inc. stock (adjusted basis

Q20: A factory building owned by Amber, Inc.

Q55: In 2018, Beth sold equipment used in

Q62: The Seagull Partnership has three equal partners.

Q64: The amount received for a utility easement

Q82: Jambo invented a new flexible cover for

Q83: In each of the following independent situations,

Q89: Pink Corporation declares a nontaxable dividend payable

Q90: If the alternate valuation date is elected

Q215: Maurice sells his personal use automobile at