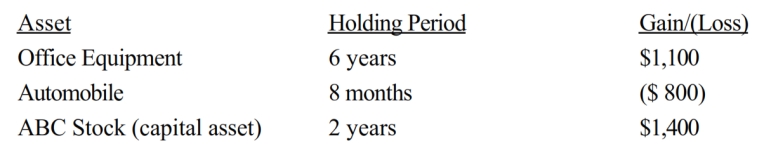

The following assets in Jack's business were sold in 2018:

The office equipment had a zero adjusted basis and was purchased for $8,000. The automobile was purchased for $2,000 and sold for $1,200. The ABC stock was purchased for $1,800 and sold for $3,200. In 2018 (the year of sale) , Jack should report what amount of net capital gain and net ordinary income?

Definitions:

Q32: Grackle Corporation, a personal service corporation, had

Q88: Rita forms Finch Corporation by transferring land

Q96: Evelyn's office building is destroyed by fire

Q99: Corporate distributions are presumed to be paid

Q100: If the cost of a building constructed

Q104: A corporation's holding period for property received

Q108: If stock rights are taxable, the recipient

Q126: The dividends received deduction has no impact

Q146: For nontaxable stock rights where the fair

Q156: The chart below describes the § 1231