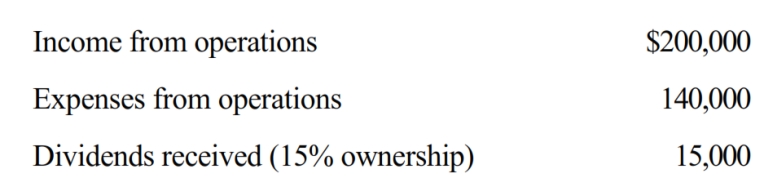

During the current year, Kingbird Corporation (a calendar year C corporation) had the following income and expenses:  On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items) . Determine Kingbird's charitable contribution deduction for the current year.

On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items) . Determine Kingbird's charitable contribution deduction for the current year.

Definitions:

Variable Selling

Costs associated with selling a product that vary with the level of sales activity, such as commissions or shipping fees.

Administrative Expenses

These are the expenses that an organization incurs not directly tied to a specific function such as manufacturing, production, or sales.

Variable Costing

An approach to costing that accounts for just the variable costs of production, including direct materials, direct labor, and variable manufacturing overhead, in the calculation of product costs.

Product Unit Cost

The total cost associated with producing a single unit of a product, encompassing both direct materials and direct labor costs.

Q9: During the current year, Kingbird Corporation (a

Q24: How is the transfer of liabilities in

Q38: Qualified property is used to determine one

Q49: What incentives do the tax accounting rules

Q54: A net short-term capital loss first offsets

Q55: In 2018, Beth sold equipment used in

Q106: Section 1231 gain that is treated as

Q134: The Code treats corporate distributions that are

Q164: During the year, Blue Corporation distributes land

Q172: Tern Corporation, a cash basis taxpayer, has