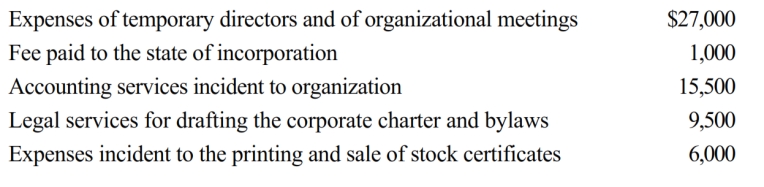

Emerald Corporation, a calendar year C corporation, was formed and began operations on April 1, 2018. The following expenses were incurred during the first tax year (April 1 through December 31, 2018) of operations.  Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2018?

Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2018?

Definitions:

Market Rate

The prevailing price or interest rate for goods, services, or securities in a competitive marketplace.

User Cost

The cost of using a good or service, which includes the opportunity cost of not using the asset in an alternative use.

Opportunity Cost

The cost of choosing one option over another, typically represented by the benefits that could have been gained by choosing the alternative.

Depletable Resource

A natural resource that can be diminished or exhausted by use, such as fossil fuels, minerals, or forests.

Q17: A liquidation can occur for tax purposes

Q38: To ease a liquidity problem, all of

Q69: Barbara operates a sporting goods store. She

Q73: A corporation with $5 million or more

Q111: What is the easiest way for a

Q113: Section 1231 applies to the sale or

Q128: Dividends taxed as ordinary income are considered

Q128: May an individual that has purchased a

Q163: The BMR LLC conducted activities that were

Q194: Hilary receives $10,000 for a 15-foot wide