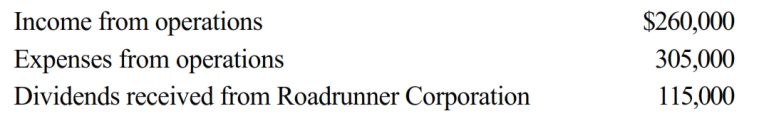

During the current year, Coyote Corporation (a calendar year C corporation) has the following transactions:

a. Coyote owns 5% of Roadrunner Corporation's stock. How much is Coyote Corporation's taxable income (loss) for the year?

b. Would your answer change if Coyote owned 25% of Roadrunner Corporation's stock?

Definitions:

Diminishing Returns

The principle stating that as one factor of production is increased while others are held constant, a point will eventually be reached where additions of the factor yield progressively smaller increases in output.

Value Added

The increase in worth of a product or service as a result of a particular stage of production or as it moves through the supply chain.

Marginal Product

The increase in output resulting from a one-unit increase in the amount of a single input used, keeping all other inputs constant.

Premium

A premium is the amount paid for an insurance policy, representing the price for the insurance coverage or the amount over the nominal value of something.

Q62: Briefly describe the accounting methods available for

Q70: The Federal income tax treatment of a

Q81: For § 1245 recapture to apply, accelerated

Q99: Corporate distributions are presumed to be paid

Q108: If a corporation is thinly capitalized, all

Q114: All distributions that are not dividends are

Q124: Section 179 expense in second year following

Q135: If the holder of an option fails

Q164: Property sold to a related party that

Q184: Federal income tax refunds from tax paid