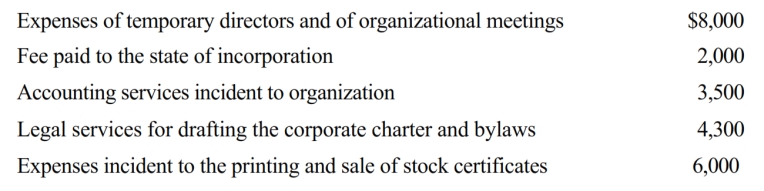

Opal Corporation, an accrual method, calendar year taxpayer, was formed and began operations on July 1, 2018. The following expenses were incurred during the first tax year (July 1 through December 31, 2018) of operations.  Assuming a § 248 election, what is Opal's deduction for organizational expenditures for 2018?

Assuming a § 248 election, what is Opal's deduction for organizational expenditures for 2018?

Definitions:

Physical Assessment

The systematic examination of the body by a healthcare provider, using observation, palpation, percussion, and auscultation, to detect any signs of disease or abnormalities.

Inspection Phase

The initial part of a physical examination where a healthcare provider visually examines a patient for any signs of abnormality.

Palpation

The act of examining part of the body by touch, especially for the purpose of diagnosing disease or illness.

Percussing

A method in medical examinations where the surface of the body is tapped lightly to evaluate the condition of the organs underneath.

Q8: A C corporation provides lawn maintenance services

Q16: If a distribution of stock rights is

Q23: Carol had the following transactions during 2018:

Q50: The following assets in Jack's business were

Q52: Ten years ago, Carrie purchased 2,000 shares

Q69: Barbara operates a sporting goods store. She

Q108: If a corporation is thinly capitalized, all

Q133: The tax law requires that capital gains

Q162: On January 1, Eagle Corporation (a calendar

Q240: If a taxpayer purchases taxable bonds at