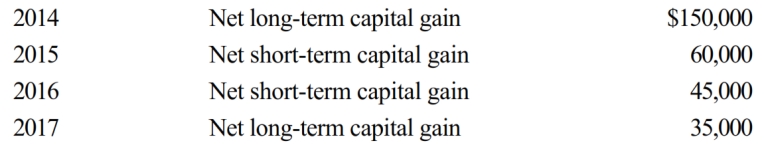

Carrot Corporation, a C corporation, has a net short-term capital gain of $65,000 and a net long-term capital loss of $250,000 during 2018. Carrot Corporation had taxable income from other sources of $720,000. Prior years' transactions included the following:  Compute the amount of Carrot's capital loss carryover to 2019.

Compute the amount of Carrot's capital loss carryover to 2019.

Definitions:

Sale-Or-Return

A sales agreement that allows the purchaser to return unsold goods to the seller rather than pay for them, typically used in retail or wholesale.

Risk Of Loss

Refers to the potential financial loss a party may face in a transaction due to damage, destruction, or theft of goods before they are delivered.

Formal Ball Gowns

Elegant and sophisticated dresses worn by women to formal events, characterized by their long length, luxurious fabrics, and ornate details.

Conforming Goods

Products or goods that meet the specifications and standards outlined in a contract or agreement.

Q29: Explain the rules regarding the accounting periods

Q36: On December 20, 2018, the directors of

Q39: During the current year, Quartz Corporation (a

Q40: Which of the following is not a

Q50: During the current year, Owl Corporation (a

Q59: For a taxpayer who is required to

Q67: If a capital asset is sold at

Q71: Rodney, the sole shareholder of Orange Corporation,

Q87: Hawk Corporation has 2,000 shares of stock

Q245: Jake exchanges an airplane used in his