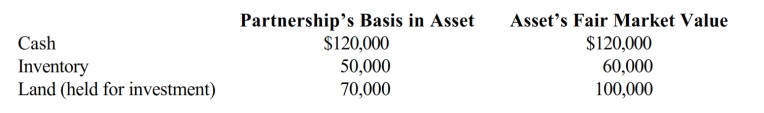

Karli owns a 25% capital and profits interest in the calendar-year KJDV Partnership. Her adjusted basis for her partnership interest on July 1 of the current year is $200,000. On that date, she receives a proportionate current (nonliquidating) distribution of the following assets.

a. Calculate Karli's recognized gain or loss on the distribution, if any.

b. Calculate Karli's basis in the inventory received.

c. Calculate Karli's basis in land received. The land is a capital asset.

d. Calculate Karli's basis for her partnership interest after the distribution.

Definitions:

Universally

In a manner that applies or extends to all cases, situations, or places without exception.

Broca's Aphasia

A form of aphasia characterized by difficulty in producing speech but relatively preserved comprehension, often due to damage to Broca's area in the brain.

Inarticulate Speech

Speech that is difficult to understand due to unclear or incomplete utterances, often resulting from emotional distress or cognitive impairment.

Grammatical Devices

Are tools used in language to convey meaning, structure sentences, and relate words to each other, such as tenses, punctuation, conjunctions, and prepositions.

Q23: Allison is a 40% partner in the

Q34: Alomar, a cash basis S corporation in

Q46: Advise your client how income, expenses, gain,

Q58: Acquiring Corporation transfers $500,000 stock and land

Q64: Troy, an S corporation, is subject to

Q69: Both of these organizations are exempt from

Q76: In general, how are current and accumulated

Q118: How does the payment of a property

Q152: Checking the customer's inventory to determine whether

Q178: A corporation that distributes a property dividend