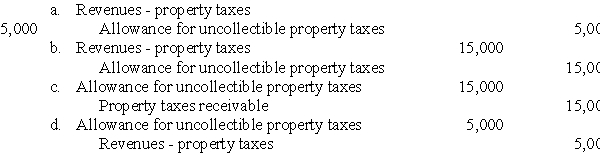

A city uses the allowance method to provide for uncollectible property taxes.At the start of the year,the city established an allowance of $100,000 for uncollectible taxes.During the year,it wrote off $80,000 as uncollectible.At year-end,the city still has some uncollected taxes,but believes it will need an allowance of only $15,000 to cover any receivables that it may need to write off as uncollectible.What adjusting entry should it make?

Definitions:

Joint Ventures

A business arrangement where two or more parties agree to pool their resources for the purpose of accomplishing a specific task, project, or business activity.

Direct Investment

The purchase or acquisition of a controlling interest in foreign businesses, assets, or properties.

Global Sourcing

The practice of seeking resources, goods, or services from the global market, typically to leverage cost advantages, expertise, or efficiencies.

Diversification

A risk management strategy that mixes a wide variety of investments within a portfolio.

Q7: A hospital invested $780,000 in equity securities

Q9: What is the maximum profit on the

Q9: The most important reason for being concerned

Q12: All of the following would be classified

Q15: Suppose it is currently July.The September futures

Q24: A box spread is a good strategy

Q25: The futures price of a non-storable asset

Q29: The General Fund transfers $500,000 to a

Q31: The Black-Scholes-Merton model assumes that the volatility

Q124: Explain how marketing creates utility and the