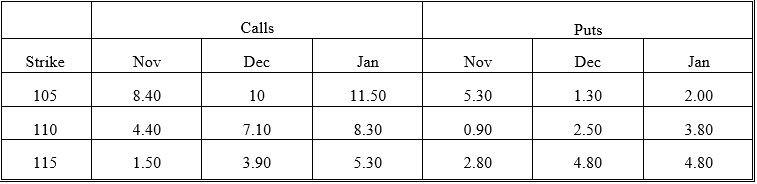

The following quotes were observed for options on a given stock on November 1 of a given year. These are American calls except where indicated. Use the information to answer questions 7 through 20.

The stock price was 113.25. The risk-free rates were 7.30 percent (November) , 7.50 percent (December) and 7.62 percent (January) . The times to expiration were 0.0384 (November) , 0.1342 (December) , and 0.211 (January) . Assume no dividends unless indicated.

-What is the time value of the November 115 put?

Definitions:

Discount Rate

It refers to the discount rate applied in discounted cash flow analysis to calculate the current value of future cash flows.

Investment in Equipment

Capital expenditure on physical assets like machinery and equipment intended to be used in the production of goods or services.

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life in consistent annual amounts.

Remodelling

The process of updating or altering the structure, layout, or appearance of an existing building or space.

Q5: When the number of time periods in

Q8: Find the profit if the investor buys

Q9: Suppose you closed the spread 60 days

Q12: Which of the following strategies replicates a

Q26: Determine the amount by which a stock

Q38: The risk of the basis is usually

Q42: What is the lower bound of a

Q45: Very few futures contracts are terminated in

Q45: The difference in profit from an actual

Q49: Which of the following are not methods